Tale of Two Tracks

Love this time of year! Grain bin fans humming at night. The coordination of equipment in the fields chasing the common goal of getting the crops in before the weather turns. It is calming and exciting at the same time. As I drove across the middle of the country last weekend taking all of this in, I caught a glimpse of a rare sight. A farmer’s entirely green fleet with one lone red tractor pulling a massive grain cart. You don’t see the mixing of colors very often, so it caused me to do a double-take and wonder why. This Steiger Quadtrac, easily housing more than 400 horses under its hood was certainly needed with the behemoth grain cart it was towing. But why adopt Case IH over John Deere if your operations so obviously slanted green?

I showed some restraint and waited until I got back to the farm before pulling out my phone and checking Iron Comps Insights to see if I could decern a difference between the quad track models of these two brands. Turns out there is quite a difference.

First of all, the track tractor auction market is dominated by John Deere, Case IH, and Challenger, with just a handful of a few others. Historically this space has been all red. Case began earlier in 1996, and held that competitive edge with a four track patent that just ran out just five years ago. Sure, other manufacturers release two track tractors, but those early models have been known to tear up the soil and be a rough ride before they improved the suspension. When looking at the Insights data, I could see the early preference for Case. For all track tractors built between 2010 & 2015, the average Case IH track price was higher than the entire group average. That changed in 2015 though when John Deere introduced the RX. These quad track models exact a much higher price right out of the factory door. Because of this higher starting price, John Deere has owned the title of higher than average price for track tractors produced in 2015 – 2017.

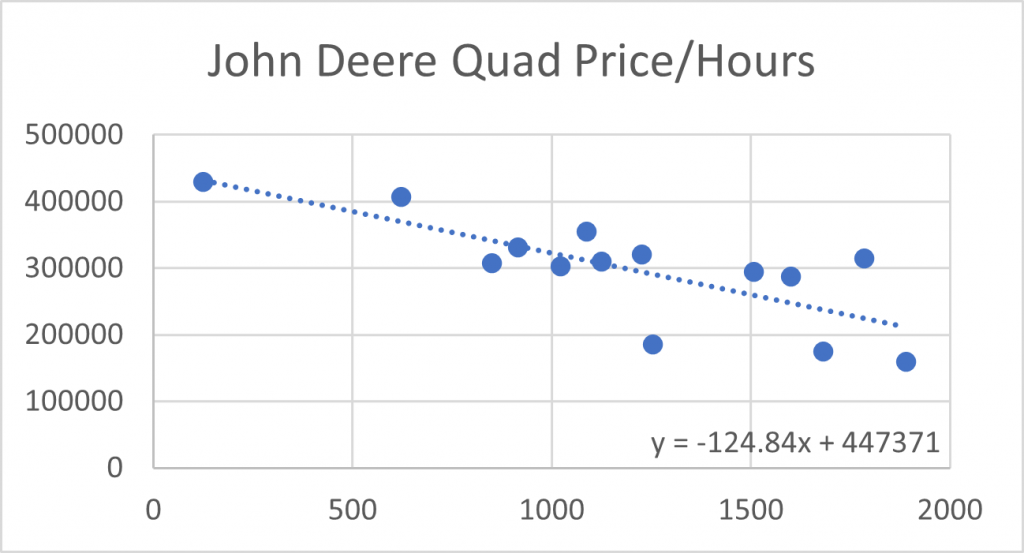

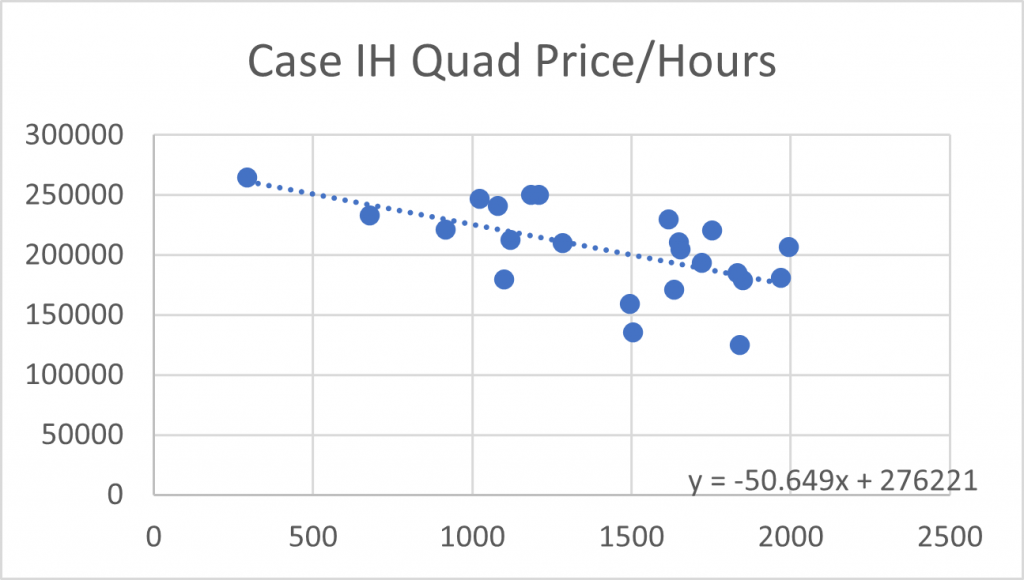

While there is a big initial price difference between red and green, what is most interesting is the different rates that these models retail value. To compare similar sets of data, I filtered and selected my Insights data to include only four track models of both Case IH and John Deere with less than 2,000 hours. This helps put Case on parity since Deere has not been in production as long and there are not as many hours accumulated on their machines.

In this analysis, John Deere has that higher initial price, but decreases in value at about the rate of $125 for every hour accumulated. Compare that with Case, whose tractors decrease in value at only $50 per hour. There are some explanations that may explain some of this discrepancy. Some Case Quadtracs are ‘scraper specials’. Models without the extras like 3-pt, PTO, or any bells and whistles in the cab. Because these models can be more basic, there is less value to depreciate with usage. Even if you are a green fan, you must give credit where credit is due. A good portion of this red retention of value has to come from the years of experience they’ve had continually improving on that early model they released back in ’96.

If you are looking to trade one of these Deere RX models, I’d suggest taking look at how Case’s Quadtrac’s have depreciated once they surpase 5,000 hours. It would be expected that the RX follows a similar trajectory.

the Keep in mind that this rate is only accounting for machines under 2,000 hours. If Deere can follow Case’s longevity model, then we might expect John Deere’s RX models to level off around $100,000 after 5,000 hours. (these last two are just random paragraphs, not sure if it fits anywhere or if I should leave it out)